The ETH Trade Updated: Oblique Yield Strategies

This wasn’t my original plan, but I’d say so far it’s going pretty well.

If you’ve been following along you’ll remember that last week I made a bet, counter-trading the founder of Size Credit.

I had two main goals with my trade: 1. Get leveraged long on ETH without paying credit card-level interest rates, and 2. Use borrowed USDC to generate some leveraged yield on the long ETH position, with the optimistic goal of earning enough yield to cover the interest costs of my Size loan.

With regards to goal #1 it’s looking good:

I’m now long for 20 ETH with an average entry of $2625, and I’ve borrowed $34k worth of USDC at an average rate of just under 7% annualized for a “health ratio” of 1.2 relative to my liquidation price. Some of that USDC has been used to achieve the aforementioned leverage, and then $15k has been allocated to goal #2. Given that the average rate to borrow USDC on Aave over the last 30 days has been over 7%, this feels like solid positioning:

Now let’s talk about goal #2. I have a hurdle of 7% to beat, but if I’m being discerning I really need to earn more like 15-16% if I’m trying to cover 7% interest on $34k in debt with $15k worth of collateral. So what are my options?

Option 1: Credit Arbitrage

The first and most obvious option to explore, lending arbitrage would look like simply taking the borrowed USDC and finding a place I can lend it for my target 16%. With the volatility of variable rate markets this is well within reason— we can see right in the Size Credit positions UI above that Aave is paying a blazing baseline variable rate of 48%, and they are one of the largest and most widely used borrow/lend platforms. So in theory I could just dump my USDC into Aave and crush that target hurdle and essentially get paid a net 32% to borrow; or better yet, with this demand surge for borrowing I could create fixed-term offers on Size to maybe lock in a very high rate, and earn that net 32% until those offers get filled.

The one drawback with this strategy is the unpredictability of that Aave yield. Just like rates can spike suddenly and burn borrowers, they can also easily plummet suddenly and hurt lenders. In general these rates are difficult to build a longer term strategy around because of that unpredictability. Despite the rate skyrocketing at the time of writing, over the last 30 days I would have in fact not cleared my target hurdle (though I would have at least discounted my cost of leverage pretty dramatically):

If you’ve noticed a spread here between borrowing and lending on Aave, you’re right: this is a fundamental limitation of Aave and other utilization rate models. If you’re unfamiliar here’s a very simple example: when $9 worth of borrowed debt is paying interest to $10 worth of lent collateral, both sides lose efficiency. Borrowers pay more AND lenders get less than if they opened their loans on Size. Yet this is the utilization rate Aave actively targets as ‘ideal’ — 90% of available capital borrowed, paying interest on 100% of the collateral. But I digress…

A potential opportunity involving Aave would be a looped arbitrage trade — I deposit my borrowed USDC on Aave and I could borrow ETH for 2.5% and layer up my Size position, borrow more USDC, and increase my Aave lending position until the net rate exceeds my hurdle. In some situations an approach like this is interesting, but the proposed loop involves borrowing ETH on Aave which introduces some additional volatility risk that I’d prefer to avoid, and cross-collateralization between Size and Aave that could get me liquidated in a big move in either direction.

Option 2: Liquidity Provisioning

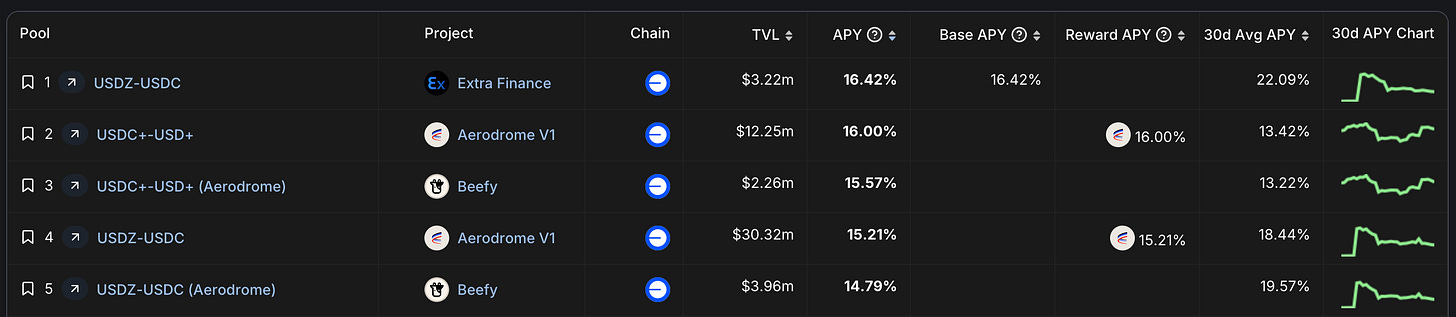

Beyond lending, another common yield opportunity in DeFi would look like depositing my USDC paired with another asset (ideally another stablecoin to avoid price risk) on a protocol like Uniswap, and earning a share of swap fees and/or protocol token emissions. There are MANY options for this approach, but ultimately I do not love any of them for two reasons. One is yield unpredictability; at times this yield can be more reliable than variable interest rates because swap volume tends to maintain a more stable trend than short term spikes and shifts in variable rate markets. However, these rates are still not 100% predictable as we can see below in the differences between current and average APRs, and some of these come with the extra gotcha of being paid out in a protocol token like AERO instead of dollar yields:

Not to mention, some of these require exposure to stablecoins I’m not as confident in as USDC like USDZ and USD+. Even though I don’t have “price exposure” if any of these stablecoins depegged from $1 I could suffer a meaningful and painful loss on a position like this.

Option 3: …Or Something Completely Different

One of the best aspects of DeFi is the agency and autonomy it empowers; once I’ve borrowed my USDC I can do whatever I want with it. Borrowing and lending protocols do not get to dictate where you can or cannot send those funds and it’s entirely at the user’s discretion to manage their debt, collateral, and liquidation risk. It also means I can do something pretty un-DeFi with that USDC even though DeFi was where it was sourced: I can send it to a centralized exchange.

Generally I do not like holding assets on centralized exchanges (“not your keys not your crypto, lest ye get FTX’d or Gox’d” is the saying, I believe). However, a pretty unique short term opportunity had presented itself that could not be overlooked. Through the month of October Bybit held its annual World Series of Trading, a wonderful time every year that the exchange truly celebrates its users’ degen trading through incentives and large giveaways including $10M cash prizes, Rolexes, and this year even a prize yacht (yes a literal yacht). These incentives are handed out for trading PnL performance which generally benefits the largest accounts — and more importantly, for market-making volume turnover as well.

That last little bit; there’s the opportunity.

If you read the initial write up you’ll recall that centralized exchanges like Bybit offer up to 100x leverage on large cap perpetual swaps like BTC and ETH. That means that with $15k in collateral I can quote $1.5M in orders — and if I can manage my risk, it just becomes a matter of turning over that collateral as frequently as possible as many times as possible. The funding rates can be egregious to hold these positions for long periods of time, but if you’re only holding them for seconds or minutes at a time you can often avoid much impact from funding rates. And as you could probably imagine if you’re not already aware, the more volume you do the less the exchange charges you in fees, allowing you to profitably quote a tighter spread than someone paying a higher fee. With a high enough volume threshold translating to ZERO fees on limit orders. I have pretty extensive experience running a strategy like this so it wasn’t difficult to get this set up, though it must be emphasized that this kind of strategy can be very complicated for the inexperienced, and can rapidly incur dramatic losses if it lacks effective risk management.

That said though, it’s turning out pretty well so far:

At the end of a very competitive WSOT, I managed to slot in 10th place doing just shy of $720M in total volume, for a prize payout of $13,000. It’s worth noting that the trading strategy wasn’t particularly profitable by itself as spreads got very compressed during the competition, and I was quoting near-zero spreads in effort to compete. But even factoring in basically flat trading performance, the $13k prize payout was well worth it considering the notional interest on my Size loans will be about $1200 in total between now and April.

The takeaway here? Explore oblique strategies. An edge is no longer an edge once it’s crowded, and if the well-trodden path can’t get you what you’re looking for then maybe trod elsewhere. If paying +40% interest on Aave feels like a midcurve approach, and a non-starter for your trading strategy, maybe lock in a reasonable rate on Size instead. Once you know your cost of capital is going to be fixed and manageable for a known, predictable period of time, the sky is the limit and you can really get creative.

The information covered is for educational purposes only and should not be construed as investment advice or general financial advice. The strategies detailed herein are complex and carry several significant risks; investors and traders pursuing any crypto or DeFi strategies could lose all of their investment and should conduct their own research and due diligence.